Who thought insurance and financial planning could become so complicated? Okay—that doesn't surprise anybody—but in a country where people, on average, outlive their savings by eight to 10 years, Runhuan Feng’s goal is to advance innovation and technology so that financial stability and security is the norm in an area of life that seems to grow more daunting every year.

Name: Runhuan Feng

Title: Professor of mathematics, statistics, and industrial and enterprise systems engineering. Director of programs in actuarial science and predictive analytics and risk management. State Farm Companies Foundation Professorial Scholar and chair of the Education and Research Council of the Society of Actuaries. He is the finance and insurance sector faculty lead with the University of Illinois System’s Discovery Partners Institute.

What's the focus of your research?

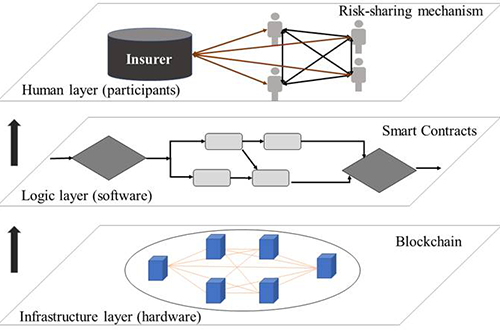

I currently focus on two areas—decentralized insurance and artificial intelligence for financial planning. Decentralized insurance builds on a network of members facing a common risk that enables them to share financial costs to cover each other’s losses. The peer-to-peer (P2P) nature of decentralized insurance enables users to trade risks without or with a reduced role from a traditional insurer. In other words, each member is both an “insurer” for others and an insured by others.

There are many new decentralized business models emerging around the world. For example, mutual aid is a new insurance model that emerged in China. Every member receives the promise of mutual aid in case of covered contingencies and commits to carry the cost of losses from other members within the risk pool. As of last year, the top 10 mutual aid platforms in China have amassed more than 300 million users and offered healthcare coverage for more than 100 critical medical conditions and illnesses. P2P insurance is another internet-enabled business model, popular in Europe and the United States. P2P insurance typically facilitates risk sharing in a small group of family members, friends, and other social relationships. All members contribute to a common fund, a portion of which is used to buy an insurance policy with a high deductible. Claimants’ losses are first paid out of the common fund. Any excessive amount beyond the capacity of the common fund is paid by the insurer. Depending on the actual losses, members may receive a refund for the remaining balance in the common fund. The success of Lemonade Inc. in the U.S. is a testimony to the viability of such a business model.

How is this different than in the past?

This concept of decentralized insurance is not a new one—early forms of mutual aid existed long before modern insurance. In ancient Rome, burial societies covered the funeral expenses of deceased members within a local community. In today’s internet era, many online decentralized insurance platforms can reach much larger communities without geographic limitations and enforce a more effective loss sharing mechanism via electronic payments. The advancement of blockchains and smart contracts enables technology firms to build trust in decentralized insurance schemes and allows participants to share risks with each other in ways that were not possible decades ago.

My research looks into the evolution, technology development, and regulation of what we can achieve with decentralized insurance. My professional goal is to bring design concepts to the development of decentralized insurance. My research team at the Illinois Risk Lab has worked on a wide range of creative models for decentralized insurance and risk sharing. Our hope is to partner with industry players to examine and bring experimental and structural designs of decentralized insurance to practice. We also hope that our research can offer a scientific basis for regulators to understand the technology development in decentralized insurance and to form policies that both ensure financial stability in the insurance market and also encourage innovation and cutting-edge technology transformation.

What about your research in artificial intelligence for financial planning?

According to the World Economic Forum, Americans outlive their savings by eight to 11 years, with women (on average) faring worse. Most Americans do not have the professional knowledge to understand the intricate and interconnected financial decisions or how to deal with life-changing contingencies and risks. Many barely survive from paycheck to paycheck and live in poverty in advanced age.

The conventional wisdom is to help people improve financial literacy. We want to challenge this thinking with a futuristic approach (based on the idea) that nobody needs to acquire financial knowledge. As much as cars can be driverless, there is no reason why our personal finance cannot be made autonomous. Our vision is to make AI technology useful to help average Americans cruise control their paths to financial freedom and worry-free retirement.

The famous Google experiment, AlphaGo, showed the limitless applications of AI technology to solve complex decision-making beyond the capability of humans in competitive games. We treat human life similarly to a complex competitive game with a set of rules in a stochastic environment. Our work is to develop AI algorithms that can project an individual’s financial future with tens of thousands of financial decisions and economic scenarios. Algorithms should be able to identify the best course of action for all aspects of an individual's financial life.

What advice do you give to students?

There is a famous quote from American architect Buckminster Fuller, “you never change things by fight the existing reality. To change something, building a new model that makes the old model obsolete.” When I teach, I share with my students the excitement of building new models and encourage them to take their own initiative to change the world in areas that need improvement. My advice is to never be afraid of having ideas that other people do not understand or appreciate.

Please describe your proudest or most significant achievement.

One of my proudest achievements has been offering advice to the state of Illinois lawmakers on pension obligation bonds. In 2017, I was approached by the State Universities Annuitants Association to provide quantitative analysis of a long-term bonding solution to alleviate the financial burden of the ongoing pension crisis on the state. My work provided the quantitative basis for the amendment to Senate Bill 661. I testified as a subject expert in a public hearing in Springfield in February 2018. Although the bill did not pass, the same idea was extended to introduce a buyout option in House Bill 3342, which was passed in May 2019.

Editor's note: This LAS Experts profile is part of a series to highlight the groundbreaking work by faculty in the College of LAS. Visit here for other profiles.